The Dot-com Bubble of the early 2000s was an economic bubble caused by the rapid rise in stock prices and speculation in companies that used new internet technologies. The term "Dot-com" is a historical reference to the .com top-level domain used in web addresses.

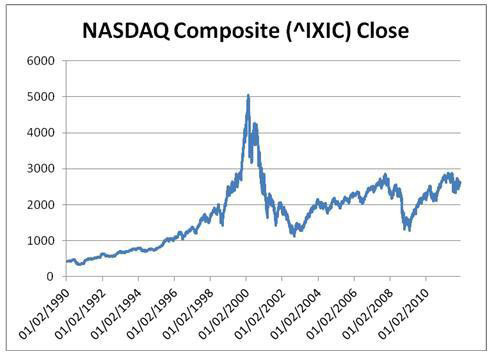

The Dot-com Bubble mainly affected public, high-growth technology companies commonly called "dot coms." Examples include stocks such as Cisco Systems, E*TRADE, and JDS Uniphase. Many investors believed that the internet would create more wealth than it did. These companies had to meet high expectations but could not live up to them. On March 10, 2000, the NASDAQ Composite stock index hit its all-time high of 5048.62. However, by October 9, 2002, it had fallen 80% to 1114.78. The Dot-com bubble is famous for being one of the most significant historical market collapses.

What caused the dot-com bubble?

The Dot-com bubble was caused by factors, including the overvaluation of internet companies relative to traditional companies and speculation that the internet would drastically increase the productivity of businesses and industries such as manufacturing or retailing, which it did not do nearly the same level as expected.

The 1990s were a time of great economic optimism. From 1991 to 2000, the U.S. GDP grew at an average rate of 4.4%. In the 1990s, the internet boomed, and usage grew rapidly, driven by advances in computer infrastructure, especially semiconductors and fiber-optic cables. Companies went online and started large-scale Internet businesses such as eBay, Amazon.com, and Yahoo!. Many other companies to mention here were created through the rapid growth of early Internet business ideas, similar to many startups today being talked about as "the next Facebook." The boom was also fueled by free capital as investors poured money into internet startups with no revenue model or a plan to make money.

The Federal Reserve and the Bank of Japan kept interest rates low. They tried creating economic growth through monetary policy to combat the stock market crash.

What caused the dot-com bubble to burst?

As with any bubble, it burst soon after its exponential growth catastrophically collapsed, leading to bankruptcy and destruction of investment capital. However, in the aftermath of the dot-com bubble, traditional investment capital began to flow into Internet startups, fueling further growth.

Inflation was low, and the Federal Reserve decided not to raise interest rates to control inflation because unemployment remained high. The availability of venture capital drove stock prices higher during the late 1990s than any time before or since. High tech industries' share of profits fell from about 50% in 1997 to roughly 25% in 2001 and 2002. Federal Reserve Chairman Alan Greenspan declined to move interest rates higher until early 2000 because he was concerned about the Chinese economic bubble (which burst in mid-2000) and the instability of rogue regimes supporting terrorism having access to nuclear weapons.

The internet was originally developed with a market orientation, serving as information exchange. In the late 1990s, certain internet companies shifted their business models to emphasize distribution and advertising revenue streams. For example, eBay's revenue model shifted from transaction-based commissions on each sale (as an auction site) to per transaction charges (on shops). Google's original advertising model was based on contextual targeting, not click-throughs or other behavioral metrics; it was changed in late 2004 to emphasize monetary value derived from ads tracking Internet users through their Web surfing behavior. (See the Google Options section below.)

With the shift from transaction-based businesses to revenue streams based on advertising and fees, there was a tremendous increase in new technologies such as pay-per-click search engines, online auctions, and online reviews. The explosion of online content distribution and advertising, coupled with the rapid growth of the credit card industry (which also relied on rapid growth), created an environment in which stocks were priced beyond their actual value.

In 1998 Paypal debuted to provide a secure way to transfer money between individuals using credit cards. This was soon followed by other companies used for payments (such as Amazon Payments or Google Wallet) or e-commerce services (such as Craigslist). The system was wide open to abuse, and this was quickly exploited. Thousands of people were charged for "obscene" materials or services that were, in fact, legal or for fraudulent goods and services (for example, credit cards issued by banks other than the one which issued the cardholder's card). The costs to consumers were huge; the FTC estimated that online fraud in 1999 cost consumers $1.3 billion (though much of this fraud existed before such payment methods became common). This is in addition to the $240 million estimated by the Department of Justice and $310 million by industry experts to be lost to more conventional credit card fraud in 1999.

In addition, many dot-com companies' business practices were also illegal. For example, some companies used the U.S. military's existing database of personnel records, called the Defense Manpower Data Center (DMDC), to seek employees to circumvent labor laws and hiring regulations.