It's an infrequent occurrence that often occurs amid a severe economic downturn when the financial system and economic forces have previously brought mortgage rates to the point where they are at or near their absolute zero limits. This instrument's primary objective is to discourage money accumulation in favour of loans, expenditures, and capital investments rather than protecting the value of cash reserves, which are impacted by negative deposit rates.

A rate of interest accurately represents the price of borrowing money. Whenever a person takes on any debt, whether a loan or a mortgage, the lending institution will cost the borrower interest on the loan. When someone takes out a loan, there are several circumstances in which the lenders may eventually pay back the borrower instead than the other way around. The current economic climate is referred to as

They do this during inflationary times when people hoard too much cash rather than using it as they await for the economy to turn around and grow again. During these times, customers may expect their money to be valued more someday than it does now. When something like this occurs, the economy's overall demand might fall precipitously, leading to prices falling to even lower levels.

It is possible that lowering the rate of interest at the reserve bank to zero will not be adequate to boost the economy both in credit and loans when there are significant indications that inflation is prevalent in the economy. This indicates that the financial system of a banking system needs to be loosened, and negative interest rates ought to be implemented.

As a result, an environment with negative interest rates exists whenever the nominal interest rate falls below 0% for a particular financial area. This implies that financial institutions such as banks will no longer get positive interest revenue from keeping their excess reserves kept with the central bank; instead, they will have to pay to do so.

Taking Into Account Particulars

Even though actual interest rates have the potential to than zero. This implies that the implementation of negative interest rates is often the consequence of a frantic and urgent attempt to stimulate wealth creation via the use of monetary backing.

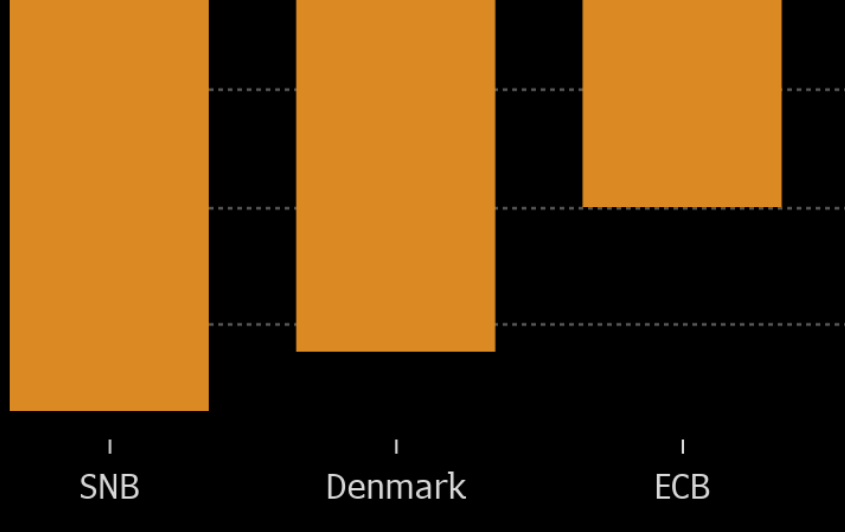

The term "zero-bound" refers to the point at which interest rates may be lowered to their most competitive level. Several lines of reasoning insist on zero being the most fundamental level. On the other hand, there have been periods when negative interest rates have remained in effect even during regular times. In the case of Switzerland, for example, the target rate of interest was -0.75%.

Banks Open to the Public

Instead of getting interested in their deposits, financial institutions have to pay interest to maintain funds on deposits with a country's central bank when interest rates are alarming. The implications of this interaction should, at least in theory, filter down to consumers and companies. On the other hand, in practice, commercial banks are often hesitant to shift negative rates on their consumers.

The Repercussions of Having Negative Rates

An unconventional method of monetary policy is known as a hostile interest rate policy (NIRP). The hypothetical lower limit for nominal goal interest rates is fixed at 0%, while the target rates are specified with a negative value.

The decline in consumer spending occurs when individuals choose to accumulate wealth instead of spending or investing it. This results in an even deeper decline in prices, a slowdown or standstill in the production stage and outcome, and a rise in the number of people looking for work.

When dealing with severe economic instability, one solution that is often adopted is fiscal policy that is loose or expansionary. However, if the causes of deflationary are powerful enough, merely lowering the interest rate in the banking system to 0 could not be sufficient to boost loans and borrowing.

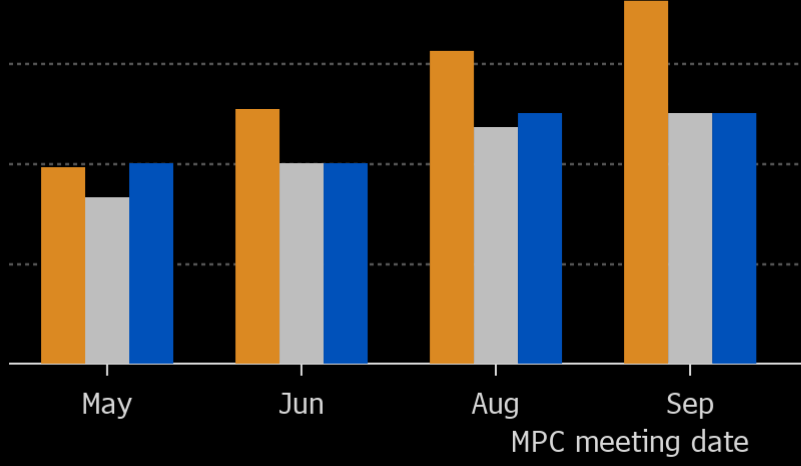

However, it is not yet apparent whether or not a NIRP is successful in attaining the aim in the nations that formed it and how it was meant to do so. It is additionally uncertain how far negative rates have effectively expanded from surplus cash deposits in the banking sector to other segments of the economy. This is another area where there is a lack of clarity.

A Real-World Illustration of Negative Interest Rates

A practice of charging negative interest rates on surplus bank deposits in the banking markets has been implemented by the federal reserve of Europe, Scandinavia, and Japan, respectively.

This unconventional monetary policy instrument stimulates economic development via spending and investment. Depositors would be motivated to spend money instead of holding it at the banks, where they'd be subject to a deficit regardless of the circumstances.