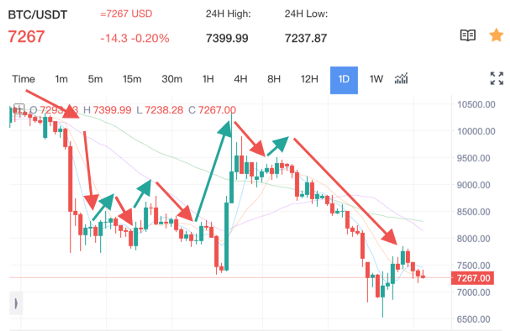

Grid trading refers to the process whereby orders are placed at or below a certain price, creating a grid of orders with gradually increasing and decreasing prices. Grid trading is usually connected to the market for foreign exchange. In general, the strategy seeks to make money from fluctuations in price within an asset by placing sell and buy orders in regular intervals, above and below a specified base price.

For instance, a forex trader might place buy orders every 15 pip over a fixed price and buy orders at 15 pip lower than that price. This makes use of the trend. You can also buy orders at a lower price and sell orders over. This makes use of ranging conditions.

Understanding Grid Trading

The advantage of grid trading is that it needs little forecasting of the direction of markets and can be automated. However, the major drawbacks are the potential for huge losses if stop-loss limitations are not observed and the difficulty associated with closing and running multiple positions within a grid.

The principle behind with-the-trend grid trades is when the price fluctuates in a steady direction; the position grows to profit from it. As the price increases, more buy orders are initiated, resulting in a larger position. The position becomes larger and more profitable the longer the price moves in this direction.

This can lead to the issue of. In the end, the trader has to decide when to stop the grid, end the trades, and then realize the profit. If they do not, the price will reverse, and the profits could disappear. Although losses are controlled through sell orders equally spread out, when they are completed, the situation could be from being profitable to losing money.

To this end, traders generally restrict their grid to the number of orders, like five. For instance, they can place five buy-orders above their price. They will exit the transaction with profits if the price is high enough to cover all buy orders. It could be done in one go or through selling grids that start at an initial target.

If the price action is volatile, it may result in buy orders over the price of the set amount and sell orders below the set price, which could result in losses. This is where the with-the-trend grid fails. In the end, the strategy is best when the price is in a continuous direction. A price that fluctuates around and around doesn't usually bring good results.

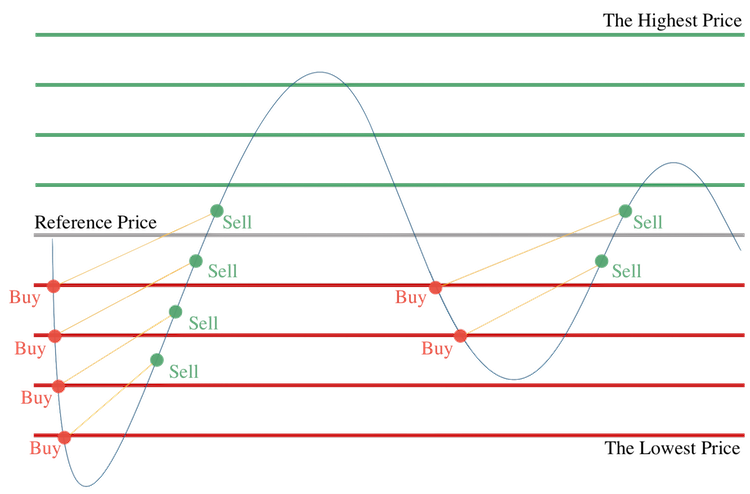

In oscillating or in-ranging markets, the grid-based trading against the trend tends to be more efficient. For instance, it is possible to place buy orders regularly lower than a predetermined price and then place sell orders at regular intervals over the price set. If the price falls and the trader becomes long. If the price rises, sell orders are activated to decrease the position and possibly even short. The trader makes money for as long as the price remains to fluctuate sideways, which triggers sell and buy orders.

The issue with the against-the-trend grid is that risk isn't managed. The trader might end up with a bigger and more significant loss if the price continues to move in one direction instead of fluctuating. The trader should establish a stop loss threshold, and they cannot keep the losing (let alone create a bigger) position for a long time.

Using a Grid Trading Strategy

Reliably

Grid trading has been used for quite a while and is regarded as a tried and profitable method. Many successful traders have used grid trading on different markets for years.

Conveniently

Grid trading is simple to learn and understand since it doesn't require complicated calculations, observations, or data analysis. This strategy can be utilized even by traders who are not experienced in the market for cryptocurrency.

Flexible Tactics

Grid trading employs the most basic principle (buy low, sell high, buy low, and earn profit from rate changes). It can be used in virtually any market and earn a profit regardless of trends or market performance.

Risk Management

This method allows traders to take control of risks better by altering the risk/profit ratio. Grids can be used to earn consistent, small profits with minimal risk by selecting a stable coin pair like BUSD/USDT or employ riskier strategies to make potentially huge profits by selecting a cryptocurrency with a lower market cap and significant fluctuations.

Tips for Grid Trading

Finding a sensible price is crucial to making sure your business plan succeeds. This implies that you should be very selective about the market conditions appropriate to your strategy to avoid being in the wrong place with the market trend.