Introduction

Being involved in using a credit card is more duty than you might imagine. Responsible credit card use, including charging only what you can afford, is essential to maintaining a high credit score. One's credit score is affected by applying for and using a credit card. Your credit score can be impacted even if you don't use credit cards. Your credit score is an indicator of the likelihood that you will repay a loan, and it is based on the information in your credit report. About once per month, your credit card company will send information about your account to one of the three major credit bureaus.

How Your Credit Score Is Determined

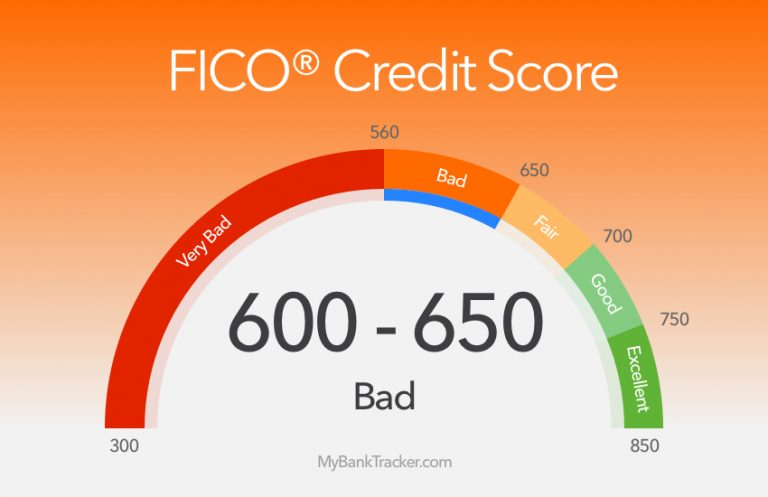

Understand how your credit score is determined before we dive into the fundamentals of credit card ownership. If you're unsure how many credit cards are too many or too few, this can help you decide. This post will take a quick look at how many credit cards you carry and how it affects your credit score.

Payment History

This has the most weight (35% of the total) and is, therefore, the most critical aspect. While this does factor in payments made toward other debts, credit card costs will likely significantly impact your monthly budget. Credit card companies are the least lenient and quickest to notify credit reporting agencies when it comes to late payments.

Debt-To-Credit Ratio

This ratio, also known as credit utilisation, evaluates how close you are to your total credit card limit regarding your outstanding debt. 30% of your credit score is based on how much of your available credit you are using. If the ratio is more than 30, your score will suffer.

Credit History Length

Here's where people who carry many credit cards can get into trouble. In the long run, your credit score will benefit from a responsible payment history. An average of 11 years has passed since the last time a person with a perfect credit score used any of their credit cards. About fifteen percent of your total grade depends on this section.

New Credit

Your credit score may decrease due to opening a new line of credit for two reasons: (1) when the creditor makes an inquiry into your credit report and (2) when the account is opened. Ten percent of your credit score is based on how much new credit you have opened.

Credit Mix

The makeup of your credit makes up 10% of your score. Debt management across various credit accounts is a positive indicator of credit reporting agencies. Your credit portfolio should include at least a few different types of loans, such as credit cards, retail accounts, instalment loans, auto loans, and a mortgage.

Your Credit Score Can Take A Hit If You Don't Have Any Credit Cards

Many consumers today choose not to carry credit cards, which could hurt your credit score if you're one of them. If you even have a credit score. A credit score can't be calculated unless some "open" accounts are listed on your credit report. Getting a mortgage, car loan, or even an apartment without a credit score is challenging. Credit cards are among the most accessible forms of credit and can be used to begin or add to a solid credit history. Your credit score will increase if you are responsible with your finances.

How Many Cards to Carry

The total number of credit cards you have and how you use them can significantly affect your credit rating. If you're starting with credit cards, it's best to use one or two and pay them off monthly. Adding credit cards for specific reasons, like a good rewards programme or obtaining better travel-related benefits, makes sense, but doing so gradually over time is preferable. If you have been using credit cards for a while and feel confident in your ability to qualify for better terms, adding a card with a significantly lower interest rate that could save you money if you plan to carry new balances may be a good idea.

Conclusion

Your credit score may be affected by your use of credit cards, mainly how you use them. Keep an eye on your credit reports and scores to understand how your credit card use influences your financial standing. Don't go closing accounts left and right if you want to cut down on your credit card usage. This will never improve your credit rating. Instead, settle your balances and keep at least your oldest card in good standing. Please don't put it in your wallet; rather, store it somewhere secure along with your other unused, older cards. Then, use it once a year to keep it active and inquire about product trading options with your issuer.