When you add more credit available, the utilization rate is also referred to in the context of your credit usage. FICO considers one of the elements in deciding on your credit score and having an unsatisfactory credit utilization ratio could negatively affect your score. Let's say that you had a credit limit of $1,000. You regularly have $800 on the card. That means that your credit utilization has reached 80 percent. Let's say you have requested an increase in your credit limit and now possess an upper limit of $5,000. If you're still paying $800 per month, your credit utilization now stands at 16 percent.

Getting the credit limit increase will reduce the credit utilization ratio and improve your credit score overall over the long run, but only if your expenses don't increase in conjunction with your credit limit. If you are spending more and max out your card to the limit you've been granted and then your percentage of credit usage will climb upwards and negatively impact your score. Most credit experts advise that you keep this ratio at or below 30%.

Lowers Credit Utilization

The FICO credit scoring model can lower your credit score when the amount of credit you've taken is close to your total credit value. This is because lenders view you as in danger of being in debt for too long, making it harder for you to make the next payments. Even if the risks don't apply to you, it's how the scoring system works as well as your score may decline as the ratio of credit utilization increases.

If, for instance, you have a credit limit and an average monthly balance of $1,800, then you're using 90 percent of your credit limit. Increasing your credit limit will decrease the amount of money utilized, reduce the credit utilization ratio, and boost your credit score.

More Affordable and Simpler To Obtain Loans and Credit

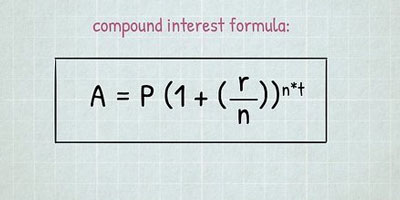

When your credit score is greater, you have greater chances of being granted the credit card you want, a car loan, or a mortgage. Additionally, you'll have a higher likelihood of receiving an interest rate that is lower since your credit score determines whether you'll receive the highest rate or a higher risk-adjusted, risk-adjusted.

Aids in an Emergency

A credit limit that is above your typical spending limit can be an option in the event of an emergency that isn't able to pay using cash. If you're on vacation, you must alter your itinerary and return to your home as soon as possible. It's probably not cheap to alter your flight ticket, but it's easy to pay for it using cards you can charge.

Helps You Earn More Reward Points

If you can pay the balance of your credit card punctually and in full, but you're not placing all your expenditures on your credit cards, it could be time to consider starting. The higher limit on your credit card will help you achieve that and boost the rewards you can earn in the form of points, cash back, and travel miles. The consensus is that you shouldn't add daily expenses like food and gas on your credit card; however, this advice is only applicable when carrying a balance. It's intended to prevent you from aggravating a problem.

However, if you don't carry an outstanding credit card balance, paying for the recurring charges on your credit cards will not cost anything and will aid in earning more rewards. These rewards could lower your expenditure in other areas, as they help pay for holidays, gifts, clothes, and nights out.

Helps You Spend More Money on Large Purchases

It is well-known how using your credit card to make large purchases is easy and helps earn rewards. You may not be aware that your card has a range of consumer protections that could assist you in the event of any issue with the purchase. For instance, Mastercard's protections are extended warranty, price protection, and protection for stolen or damaged items. American Express offers similar benefits.

Aids in avoiding Credit Score Problems

One method to gain access to more credit is to apply for another credit card. However, raising the limit on your existing card may be the best option. Opening a new credit card could hurt your score. Signing up for a brand fresh account cuts the duration of credit histories, and a long history usually will increase your score. Your age, the date of opening your first account and those of your new account, and your average age for all of your accounts are considered when calculating how long your credit history is. This factor affects approximately 15 percent of your credit score.